Secure Payments White Paper

THE TOTAL ECONOMIC IMPACT OF IBM SAFER PAYMENTS

Cost Savings And Business Benefits Enabled By Safer Payments

Executive Summary

The introduction of real-time payments, new types of financial services products, and disruptive technologies has fostered an environment ripe for bad-actor exploitation. Organisations using IBM Safer Payments can harness machine learning to improve fraud management performance, minimise fraud losses, reduce false-positive rates, lower the costs of investigation, and overcome the limitations of legacy fraud management methods, saving millions of dollars without hampering genuine activity.

INTRODUCTION

IBM commissioned Forrester Consulting to conduct a Total Economic Impact™ (TEI) study and examine the potential return on investment (ROI) enterprises may realise by deploying IBM Safer Payments. The purpose of this study is to provide readers with a framework to evaluate the potential financial impact of IBM Safer Payments on their organisations.

Fraud and payments have been intertwined since the early days of bartering. The evolution of financial instruments and the emergence of new payment channels and vendors have presented bad actors with new avenues to commit fraud and evolved the fraud prevention market.

Professionals specialising in antifraud are increasingly challenged to develop new behavioral patterns and models to detect cybercriminal activity across a wide variety of payment channels. Many turn to IBM Safer Payments to provide real-time fraud prevention for all cashless payment systems. With IBM Safer Payments, organisations can leverage machine learning capabilities and deploy new models to combat the increasing volume and complexity of fraud attacks.

The IBM Safer Payments solution builds upon an organisation’s legacy statistical models by adding direct detection features as it evaluates financial institution-specific transactions. The solution uses AI capabilities to evaluate current rules used to detect fraud as well as suggest new or enhanced rules, validate them, and implement them within days. The system can even identify new, emerging fraud trends. AI generates recommendations for human analysts to improve rule sets and test suggestions without interrupting production; analysts can then choose whether to include the recommendation. IBM Safer Payments also creates a profile per person or per merchant, and the system looks across channels for similar transactions, creating contacts between people and a more robust view of the transactor.

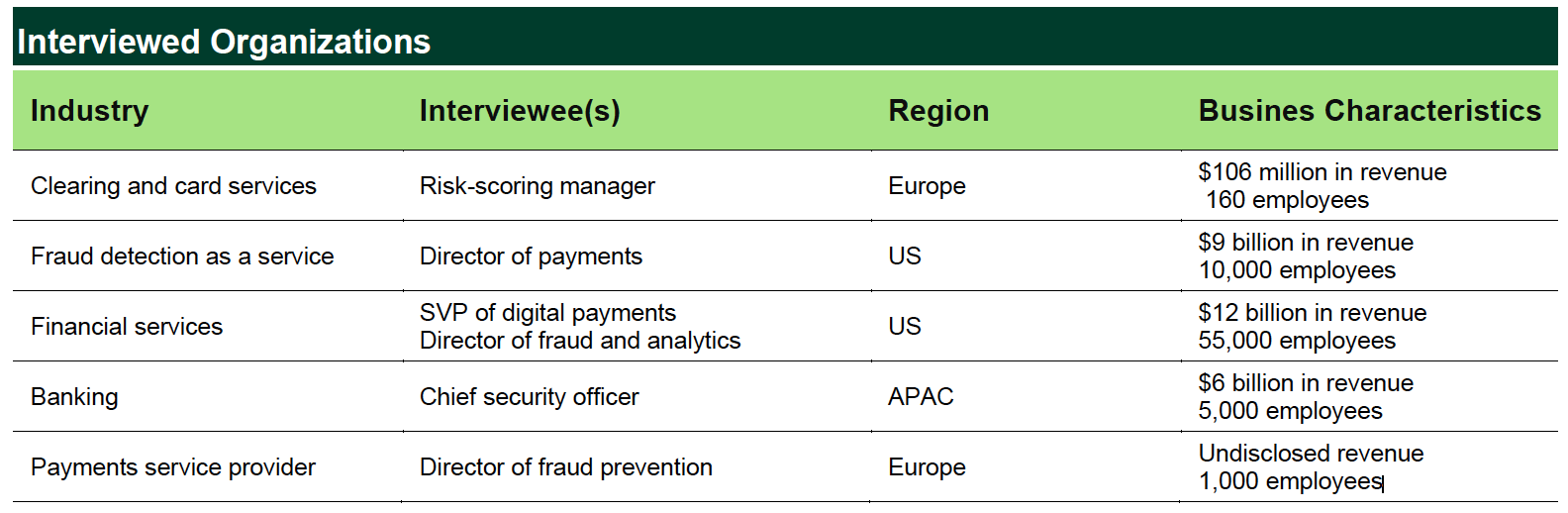

To better understand the benefits, costs, and risks associated with this investment, Forrester interviewed five customers with experience using IBM Safer Payments. For the purposes of this study, Forrester aggregated the experiences of the interviewed customers and combined the results.

KEY FINDINGS

Quantified benefits.

Risk-adjusted present value (PV) quantified benefits include the following, modeled by the composite organisation:

Better fraud detection results in avoided fraud losses of $13.0 million. The improved performance and scale of IBM Safer Payments over rules-based methods result in the reduction of basis points lost to fraud in both the digital and card channels. Over three years and a cumulative total of 8 billion transactions annually, the avoided fraud losses are worth more than $13.0 million to the organisation.

Improved model accuracy reduces false-positive rates by up to 77% and improves analyst productivity. IBM Safer Payments models improve accuracy based on transactional data, navigational data, and analyst decisions, culminating in lower false-positive rates and providing analysts with the information necessary to evaluate transactions more efficiently. Over three years and a cumulative total of nearly 90,000 avoided analyst review hours, the improvements are worth more than $2.7 million to the organisation.

The organisation avoids $1.0 million in one-time legacy system upgrades and $230K annually for ongoing licensing costs. The legacy rules-based systems are high-maintenance, requiring costly tuning and annual updates. Over three years, the organisation saves $1.3 million by avoiding upgrades and licensing costs.

Unquantified benefits.

Benefits that are not quantified for this study include:

The creation of a new revenue channel by offering IBM Safer Payments as a service to clients.

Savings through reliance on business units rather than outside vendors or consultants.

The ability to increase the frequency and speed of model changes.

Decreased transaction friction and in-tact customer experience due to faster risk scoring (in milliseconds).

Improved employee experience with user-friendly UX that makes necessary information available in one location.

Extended solution effectiveness due to evolution with an open environment, resulting in a longer-term investment.

Deeper relationships with clients by collaborating and offering controlled access to rule sets.

Costs.

Risk-adjusted PV costs include the following, modeled by the composite organisation:

Internal costs include implementation labor over eight months and supporting hardware costs totaling $356K. Hardware purchases and dedicated internal business and technical resources support the implementation over the course of eight months, costing $356K to the organisation.

Payments made to IBM include three-year IBM licensing, support, and implementation consulting cost, totaling $5.4 million. External costs include annual licensing costs covering 800 million annual transactions and a one-time fee of $600K for implementation consulting services.

An operations manager and analysts provide ongoing tuning and optimisation of IBM Safer Payments, totaling $1.2 million. Internal labor costs include one operations manager and up to five analysts. The ongoing costs total $1.2 million to the organisation.

The customer interviews and financial analysis found that a composite organisation experiences benefits of $17.0 million over three years versus costs of $7.0 million, adding up to a net present value (NPV) of $10.0 million and an ROI of 144%.

The beauty of Safer Payments is the confidence that we have in the rules and the models and the ability to detect fraud very, very fast with low false positives.

— Chief security officer, banking

TEI FRAMEWORK AND METHODOLOGY

From the information provided in the interviews, Forrester constructed a Total Economic Impact™ framework for those organisations considering an investment in IBM Safer Payments.

The objective of the framework is to identify the cost, benefit, flexibility, and risk factors that affect the investment decision. Forrester took a multistep approach to evaluate the impact that the IBM Safer Payments can have on an organisation.

DUE DILIGENCE

Interviewed IBM stakeholders and Forrester analysts to gather data relative to IBM Safer Payments.

CUSTOMER INTERVIEWS

Interviewed five decision-makers at organisations using IBM Safer Payments to obtain data with respect to costs, benefits, and risks.

COMPOSITE ORGANISATION

Designed a composite organisation based on characteristics of the interviewed organisations.

FINANCIAL MODEL FRAMEWORK

Constructed a financial model representative of the interviews using the TEI methodology and risk-adjusted the financial model based on issues and concerns of the interviewed organisations.

CASE STUDY

Employed four fundamental elements of TEI in modeling the investment impact: benefits, costs, flexibility, and risks. Given the increasing sophistication of ROI analyses related to IT investments, Forrester’s TEI methodology provides a complete picture of the total economic impact of purchase decisions. Please see Appendix A for additional information on the TEI methodology.

THE IBM SAFER PAYMENTS CUSTOMER JOURNEY

Drivers leading to the Safer Payments investment

KEY CHALLENGES

Before turning to IBM Safer Payments, the interviewed organisations relied on complex fraud detection technology stacks that combined in-house custom solutions and third-party fraud prevention tools. These solutions generated several pain points for the …